Blog

IPI Partners, LLC Pays $11.5 Million Penalty for Apparent Violations of Ukraine-/Russia-Related Sanctions Involving Russian Oligarch

On December 2, 2025, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) announced a settlement with IPI Partners, LLC ("IPI"), a Chicago-based private equity firm specializing in data centers, for apparent violations of the...

OFAC Fines U.S. Real Estate Investor $4.7 Million for Willful Violations Involving Blocked Russian Property

On November 24, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) announced a $4,677,552 civil monetary penalty against an anonymous U.S. individual (referred to only as “U.S. Person-1”) and their Atlanta-based real estate...

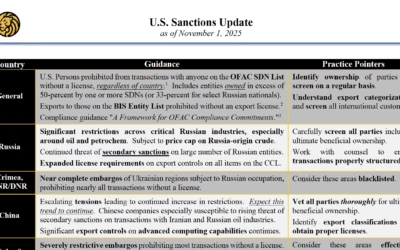

Quarterly Trade Compliance Update – November 2025

Each quarter, I send my clients a trade compliance update, highlighting important developments over the last few months and summarizing key points for important sanctions programs. If you would like to be added to the distribution list, please email me at...

Navigating OFAC Sanctions Risks From North Korean Remote Workers

With the continued rise in remote work, companies now face a unique vector for potentially significant sanctions risks that continues to catch even the most vigilant companies off guard. This threat comes from the Democratic People's Republic of Korea “DPRK” or...

OFAC Increases Sanctions on Rosneft and Lukoil, Adding Both to the SDN List

On October 22, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) has issued full blocking sanctions on Open Joint Stock Company Rosneft Oil Company (“Rosneft”) and Lukoil OAO (“Lukoil”) pursuant to Executive Order 14024. This...

Cryptocurrency Compliance Lessons from ShapeShift’s OFAC Sanctions Violations

On September 20, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) announced a settlement agreement with ShapeShift AG, which was formerly a prominent cryptocurrency exchange. The company agreed to pay $750,000 to settle its...

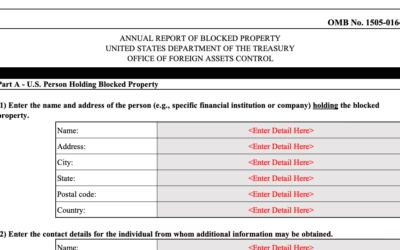

Reminder to file your 2025 Annual Report of Blocked Property With OFAC: Due date September 30, 2025

On September 15, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) issued its “Reminder to File the 2025 Annual Report of Blocked Property.” Entities or persons subject to the reporting requirement under 31 C.F.R. § 501.603 of the...

Fracht FWO Inc. Fined $1.6 million for ‘Reckless Disregard’ of OFAC Sanctions

On September 3, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) announced a settlement agreement with Fracht FWO Inc. (“Fracht”) to settle apparent violations of multiple sanctions programs. Fracht, an international freight...

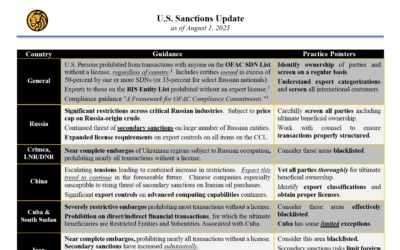

Quarterly Trade Compliance Update – July 2025

Each quarter, I send my clients a trade compliance update, highlighting important developments over the last few months and summarizing key points for important sanctions programs. In addition to a variety of ad hoc designations, below is a summary of key events this...

OFAC Fines Harman International $1.4 Million for Iran Sanctions Violations

On July 8, 2025, the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) announced a settlement with Harman International Industries, Inc. (“Harman”) for $1,454,145 to settle potential civil liabilities stemming from eleven apparent...

Key Holdings, Inc. Pays $608,825 for Cuba Sanctions Violations from Failing to Educate Acquired Foreign Subsidiary

On July 2, 2025, The U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) announced a settlement agreement for $608,825 with Key Holdings, Inc. (“Key Holdings”), a Delaware-based global logistics company. The settlement resolves potential...

Important Sanctions Compliance Lessons from OFAC’s $11.8m Settlement with Interactive Brokers

On July 15, 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) announced a settlement agreement with Interactive Brokers LLC (“Interactive Brokers”) violations of multiple U.S. sanctions programs. OFAC identified 12,367 apparent...